Give your employees a roadmap to retirement

Give your employees a roadmap to retirement

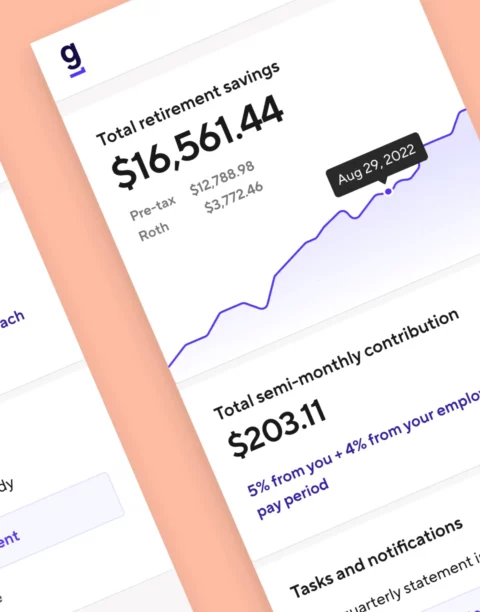

Guideline is on a mission to make it affordable for small businesses to offer a 401(k). They take care of plan administration, record keeping, employee onboarding, and more. Best of all? They’re fully integrated with TriNet HR Platform, so it’s easy to set up.

A seamless 401(k), with affordable monthly pricing and no transaction fees.

Full integration

Connect Guideline with your TriNet HR Platform account to automatically sync employee data and payroll deferrals and automate 401(k) deductions on each pay run.

Transparent pricing

Guideline’s most popular plan is $89/mo +$8 per active participant. Participants pay an account fee starting at 0.15%, which comes out to about $1.25 a month for every $10,000 saved.*

Intelligent investments

Participants can create a custom portfolio by choosing from a curated set of low-cost mutual funds or pick a managed portfolio that aligns with their investment objectives.

*This information is for illustrative purposes only, and is not intended to be construed as investment or tax advice or as an assurance or guarantee of future performance. Investing involves risk, and investments may lose value. Information shown here assumes a static balance of $10,000 per month, an assumed annual account fee of 0.15% on assets under management (calculated and deducted on a monthly basis at 1/12 of the annual stated rate (0.15%) based on the month-end account balance) and does not account for common factors that affect the value of your account balance over time such as gains, losses, distributions, additional contributions, etc. The fee presented does not include other fees that a 401(k) participant may incur, including, but not limited to, fees charged by the mutual funds or the monthly maintenance fee to participants who end employment. Alternative account fee pricing is available, ranging from 0.15% to 0.35%. Contact Sales at [email protected] to learn more about exclusive pricing options available in Enterprise tier. See our Form ADV 2A Brochure for more information regarding fees.