There are certain scenarios in which employers can change employees’ time cards. But employees, managers and HR pros should all know that intentionally falsifying time sheets is a violation of federal and state law.

Payroll managers, payday is coming, and you’re in the process of reviewing your employees’ timecards. You notice what seems to be an error on one of the records. You decide to change the timecard information to reflect what you believe it should be.

But are you legally allowed to modify employees’ timecard information? Reason or rationale aside, the legality of an employer changing time card information should be the first consideration.

Employees wondering, Can my employer change my time card? also need to know the rules.In short: While often you can legally change employees’ timecard information, there are some critical exceptions to consider.

What Federal Law Says About Changing Employees’ Timecards

The Fair Labor Standards Act (FLSA) requires employers to keep specific records for each nonexempt employee. These include total hours worked each workday and each workweek. The employer is responsible for not only maintaining records of employees’ hours worked, but also paying for all hours worked. So is it illegal to change an employee’s time card if there’s a discrepancy? Employers can change employees’ timecards — so long as the adjustment correctly depicts the hours that the employees actually worked.

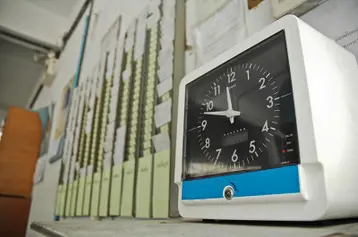

As the employee’s boss, you’re responsible for reviewing their submitted weekly timecard. You should ensure that the data is correct before approving and sending the timecard to payroll for processing. This is true regardless of whether you use a paper timekeeping system, an electronic method (such as email) or an automated cloud-based platform.

When Can You Change Employees’ Timecards?

While the legalities of changing employees’ timecards are somewhat straightforward, nuance, ignorance or misinformation can create confusion. It’s not uncommon for employers to err and for employees to become suspicious of these events. If an issue persists, they may even wonder, Can I sue my employer for changing my time card?

So, employees, is it legal for a manager to change your time card? We’ll refer to all appropriate authorities as “management” here, and the answer is yes, if you:

- Forgot to put your start or end time on your timesheet or forgot to punch in or out on the timeclock. Management can fill in the missing entries or punches.

- Failed to clock in or out during your break or lunch period. Management can fill in the break and lunch times taken.

- Called in sick or took vacation time. Management can adjust your timecard to reflect the sick or vacation time.

- Took a half day off from work for personal reasons. Management can fill in the paid or unpaid personal time off.

- Weren’t able to access the timekeeping system due to technical issues. Management can fill in the missing punches.

- Double-punched the timeclock. Management can remove the extra punch.

- Wrote the incorrect number of hours on your timesheet. Management can set the record straight.

And what about assumptions? Is it illegal for an employer to change your time card based on an unverified supposition? It could end up that way.

Employers, don’t take the risk. When in doubt about an issue, contact the employee to verify their timecard information before you make the change. For example, if an employee fails to clock in or out, you might not recall their exact arrival or departure times. You should check with them first, instead of guessing. Also, check the employee’s paid time off balance before making timecard edits for PTO.

After editing an employee’s timecard, send the updated information to the employee to review before approving it for payroll processing. This way, you and the employee can resolve or preempt any issues.

When Can’t Employers Change Employees’ Timecards?

The FLSA makes clear that employers must pay nonexempt employees for all hours worked. Therefore, it is illegal to intentionally falsify an employee’s timecard, even for mutually agreeable objectives or effects.

Can your employer change your time card for the benefit of the company?

No, not even for seemingly “smart” budgetary reasons. For example, employers cannot change a nonexempt employee’s work hours from 48 hours to 40 hours to avoid paying overtime expenses. Where overtime laws apply, if the employee worked 48 hours, they must be paid for 40 hours at their regular rate and 8 hours at their overtime rate.

Can my employer adjust my timecard for disciplinary reasons?

Employers also cannot change employees’ timecards:

- As a form of punishment (e.g., by reducing hours worked).

- To avoid paying for authorized breaks.

In short, any timecard manipulation that causes the employee to be shortchanged is unlawful.

Can You Change Remote Employees’ Timecards?

As with onsite employees, you can modify remote employees’ timecards, provided the change does not cause the employee to be underpaid.

Timekeeping for remote employees can be challenging due to the distance involved. Although utilizing a cloud-based timekeeping system makes it easier to track remote work hours, there’s still the potential for missing or erroneous timecard entries. There’s also the chance of remote employees performing unauthorized work.

As stated earlier, employers are ultimately responsible for maintaining records of hours worked. However, in August 2020, the United States Department of Labor (DOL) issued a bulletin clarifying time tracking for remote employees.

The bulletin says that the onus is on the employer to prevent “work when it is not desired” and that merely developing a rule prohibiting unauthorized work is not sufficient. “Management has the power to enforce the rule and must make every effort to do so.” That said, the employer is under no obligation to compensate remote employees for unreported work hours “that the employer did not know about, nor had reason to believe was being performed.”

According to the DOL, remote employees are responsible for tracking their hours worked as long as they receive the tools to do so. This means the employer must establish a reasonable reporting system that remote employees can use to report both scheduled and unscheduled time worked.

What Are the Penalties of Falsifying Employees’ Timecards?

Employers can face serious consequences for illegally altering employees’ timecards. Consequences may include:

- Wage and hour complaints or lawsuits.

- Mandatory payment of back wages.

- Attorney fees.

- Criminal or civil penalties under federal and state laws.

- Additional miscellaneous damages.

Several investigations have resulted in the employer facing liability for falsifying employees’ timecards. For example, in the case of Santonias Bailey v. TitleMax of Georgia, the plaintiff (Bailey) sued his employer (TitleMax) for unpaid overtime. Bailey’s supervisor also repeatedly changed Bailey’s timecards to reflect fewer hours than he worked.

The Court of Appeals held that Bailey “was not paid because his time records were not accurate. They reflected an artificially low number of hours worked. This inaccuracy came from two sources: first, Mr. Bailey underreported his own hours by working off the clock. Second, Mr. Bailey’s supervisor changed his time records to decrease the number of hours he reported.”

The court deferred to the FLSA, which dictates that if the employer knew or had reason to believe that the employee worked the unreported hours, then the employer must pay the unreported hours.

In the end, falsifying an employee’s timecard is simply not worth it.

Employers and HR departments seeking payroll accuracy, efficiency and compliance have more options than ever. For reliability in scheduling and tracking time, attendance and payroll for employees, contractors and freelancers, consider an automated cloud-based platform or software solution or more expansive outsourced services. Contact TriNet to learn more about solutions to suit your needs.