It can be nerve-racking watching the stock market fluctuate. That’s why it’s important to talk to your employees about their 401(k) retirement plans.

When global markets drop a lot, like this past month, it’s natural to get anxious when thinking about your investment portfolio. There’s a lot of money in the markets and it’s almost completely out of our control. When it comes to investments for most people, there’s one giant elephant in the room financial markets — their 401(k).

If you’re an employer, a turbulent market can impact you in 2 ways. Not only are your own personal investments taking a hit, but your employees are likely reaching out to you with their concerns. And for good reason. As the provider of a financial benefit like a retirement plan, many employees look to you for guidance.

So, what can you say to your employees? It’s no easy task whether you’re financially savvy or a 401(k) novice. No one knows exactly how or when markets will turn. The first thing you should tell your employees is to be patient. But assuming your employees would like a little more assurance right about now — and assuming they are 5 or more years away from retirement — here are the 4 things we’d tell them during this stressful time.

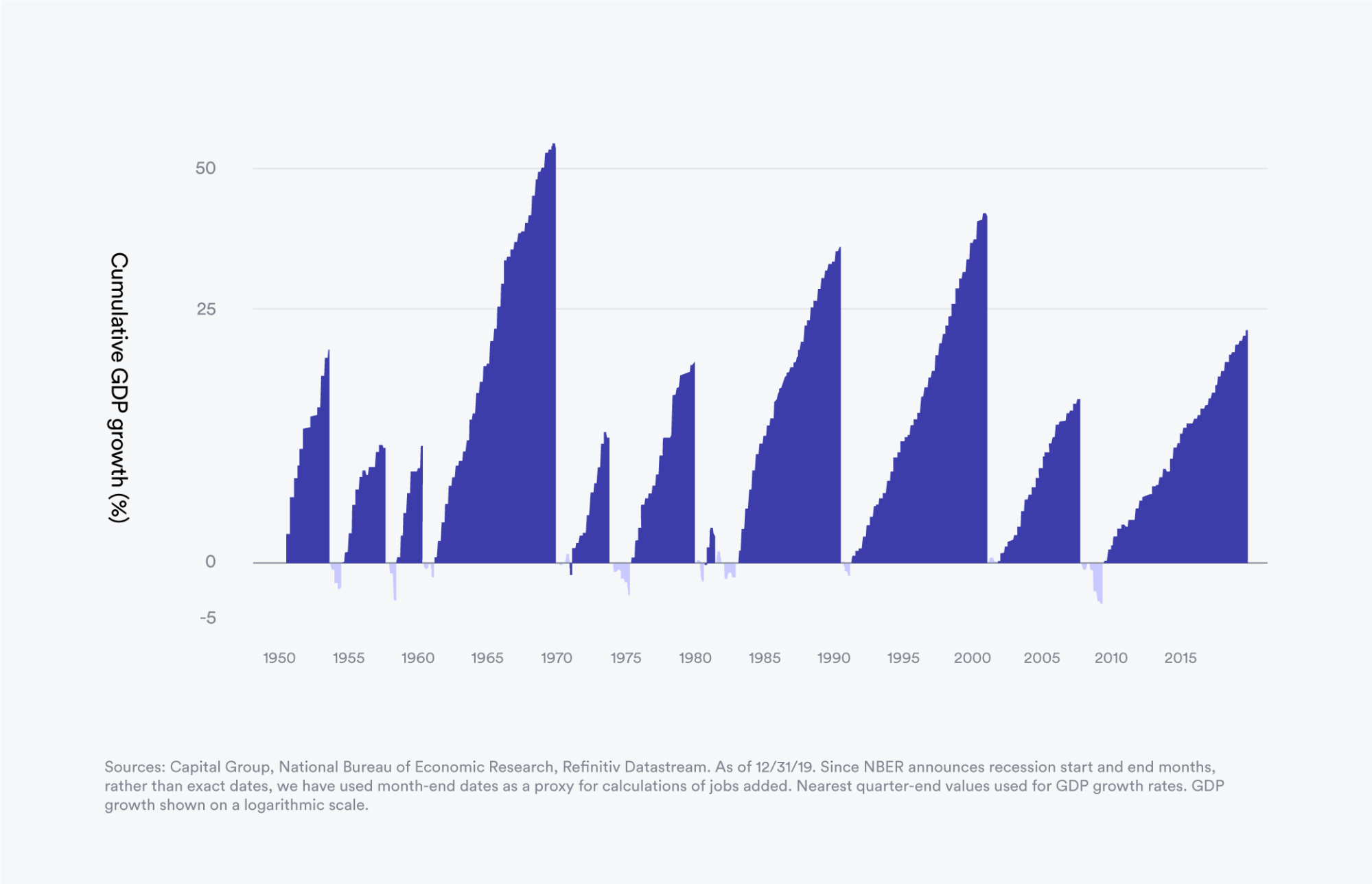

1. The stock market has been up more than it’s been down. A lot more.

While the stock market has had some infamous falls, historically, the stock market has always rebounded over time. In fact, recessions don’t tend to last very long — the average recession is 11 months. Compare that to periods of expansion where the average time is 5.6 years. The chart below illustrates historical ups and downs from 1950 to 2019, and as you can see, periods of growth far exceed market downturns.

2. 401(k) plans are long-term savings vehicles

While employees are contributing to their 401(k) accounts today, the money is meant for retirement. Not next month. The more they save, and continue to save, the better off they’ll be in the long run. Short term market volatility, like what we are experiencing now, doesn’t usually matter in the long run. By keeping money in the market and continuing to contribute and invest, your employees can take advantage of buying when prices are low — which could help even more when it’s time to retire.

3. 401(k) providers have their backs

401(k) plans were designed to benefit both employers and employees. The Employee Retirement Income Security Act of 1974 (ERISA) was created to impose strict standards of conduct, responsibility, and obligations for 401(k) plan fiduciaries. Among other things, 401(k) plan fiduciaries are responsible for ensuring the plan’s investments are diversified and for managing the plan with only the interests of participants and their beneficiaries in mind.

Guideline serves as the 3(38) plan fiduciary for all of our plans. Our investment philosophy revolves around having a low-cost, passively managed portfolio that’s broadly diversified — setting employees up for positive long-term financial outcomes.

4. If investments were good in January, they’re likely good long term

If your employees felt good about their portfolio before the downturn, they should feel good about its long-term growth, too. Watching investment portfolios lose value isn’t fun, but market volatility and occasional downturns are usually a (temporary) part of the process. Portfolios that are broadly diversified and align with an investor’s age, risk tolerance, and time horizon can usually weather short term market volatility.

During stressful times like these, we think it’s best to focus on what you have control over like your overall asset allocation and contributions. Things like day-to-day changes in public policy and market volatility are beyond our control and shouldn’t be considered for long term investing. (Easier said than done, we know.).

We recently looked at our own investor data, and saw that 98% of our 401(k) investors are leaving their portfolios alone — a really positive sign. We’ve written about this before, but even still, our best advice can be hard to stomach: avoid looking at your retirement accounts, take a few deep breaths, and keep contributing through your regular payroll deductions.

No one can predict when the market will turn or how it will look when it does. But history has shown us time and again that the market will turn — and probably with some force. If your employees come to you for some financial advice, we hope these reminders can equip you with the historic knowledge and long-term perspectives you need to guide them with confidence.

The information above is provided for educational purposes only and should not be construed as personal investment advice or a guarantee of performance. All investments involve risk and your investments could lose value. You are advised to consult a qualified financial adviser or tax professional before relying on the information provided herein.