There’s a lot of misinformation about 401(k)s — that’s why we brought in the experts. Here are the answers to the most common 401(k) questions.

When it comes to seeking advice on our savings, we’re lucky to have dependable, trustworthy partners in the retirement planning space. To disseminate this helpful advice, we took to Twitter to chat back and forth with our friends at Guideline to share answers to these FAQs. Here are the most common 401k questions.

{Question 1} Hey @Guideline401k, how does a #401k compare to an #IRA? #Why401k

@Guideline401K: Hi, @Zenefits! Both are good ways to lower taxes on #retirement savings. You can contribute more to a #401k, and your employer may match it.

The deeper dive:

A 401(k) and an IRA are both retirement plans that help you lower the amount of taxes you have to pay on the money you’re saving for retirement. You set up your own IRA, and you can contribute up to $5,500 in 2018 (or a little more if you’re nearing retirement age). For your 401(k), your employer does most of the heavy lifting, including setting up direct deposits from your paycheck so you don’t have to worry about remembering to contribute. You can contribute up to $18,500 (plus an additional $6,000 if you’re over the age of 50) in 2018.

To make sure you’re really saving for retirement, both types of plans make it a little hard to withdraw your money before a certain age — withdrawing or borrowing money from a retirement plan before you’re 59½ can mean penalties and administrative hassles.

So where should you put your savings? If you have enough discretionary income to contribute to both, doing so can help you save more for retirement. In choosing one, the first thing to think about is whether your employer matches the contributions you make to your 401(k). If they do, it means you get additional money contributed on your behalf. On the flip side, some — but certainly not all — 401(k) plans charge management fees that can eat into your savings over time, so an IRA may be a better place to contribute first. It’s a big decision, so take a close look at your 401(k) plan to understand the tradeoffs.

{Question 2}: @Zenefits: Hey @Guideline401k, how does investing in a #retirementplan impact my career goals? #Why401k

@Guideline401k: Is this a trick question, @Zenefits? In theory, investing in a 401(k) is all about having a great #retirement!

The deeper dive:

There are a few ways your career goals and your retirement plan can affect each other. The most obvious is that the path you take in your career will dictate how much you earn and how much you can save for the future. But you’ll also have choices between jobs that have good retirement plans and jobs that offer a so-so plan (or none at all). When you get a job offer, make sure you learn a little about your employer’s plan. Ask about matching contributions and fees, because they can have a huge impact on how much you save over time. Last but not least, remember that you can’t withdraw from a retirement plan without penalties until you’re 59 ½. If you want to retire sooner, your entire nest egg will have to include other investments, too.

{Question 3}: @Zenefits: Hmmmm. How do I know if I’m contributing enough to my #401k plan @Guideline401k? #Why401k

@Guideline: How much should you contribute, @Zenefits? It depends! Don’t leave your employer’s matching contribution on the table, though.

The deeper dive:

How much you contribute to a 401(k) really depends on your financial situation. If you’re sitting on high-interest credit card debt or having a hard time paying the rent, you might need the cash now. On the other hand, your employer may match the contributions you make, which means you’re walking away from income by not contributing. If you’re comfortable putting money away for the long term, making routine 401(k) contributions can really add up over time.

If you have extra discretionary income, it’s a good idea to contribute at least enough to take advantage of your employer’s matching contributions. Beyond that, anything you contribute to your 401(k) will have tax advantages over traditional investment accounts, so many people who are comfortable with putting money out of reach until retirement will max out their 401(k) and IRA each year before investing elsewhere.

Want a little inspiration? If you contribute $5000 a year over the course of a 40-year career, you could wind up with over $1 million by retirement age — provided your investments grow at historical averages of around 7% per year.

{Question 4} @Zenefits: What do I do w/ my #401k when leaving a job? #Why401k

@Gudeline: You can leave it in place, or you can #rollover your 401(k) to an #IRA account you manage, @Zenefits. There are penalties if you cash it out.

The deeper dive:

When you leave a job, you don’t have to do anything with your 401(k) if you don’t want to. However, departing employees can often reduce fees and simplify their lives by consolidating their 401(k) accounts into one, or into an IRA account that they manage on their own. It’s a pretty simple process and it preserves all the tax benefits of your 401(k) plan.

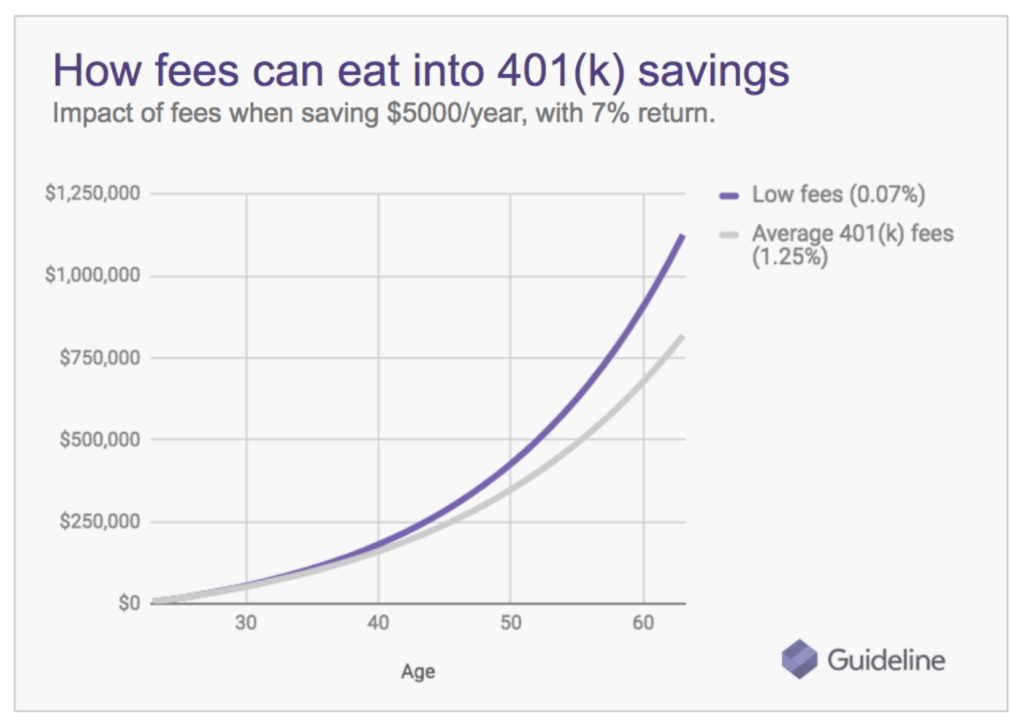

Pro tip: Make sure you understand those fees. Here’s what fee they can do to your savings over time:

The graph above is provided for informational purposes only. This projection is hypothetical in nature and intended to be illustrative. Accordingly, such information is not intended to constitute investment advice nor an assurance or guarantee of future performance. Past performance does not guarantee future results. Investing involves risk and investment may lose value. Investments are not FDIC insured.

{Question 5}: @Zenefits: How do businesses benefit from setting up a #401k, @Guideline401k? #Why401k

@Guideline401k: For #smallbiz, offering a 401(k) can mean tax savings and happier employees.

The deeper dive:

For a small business, offering a 401(k) can mean both tax savings and happier employees. The IRS gives a $1500 tax credit over three years for certain businesses that offer retirement plans. Businesses can also deduct the costs of administering their 401(k) plan, and pre-tax employee contributions reduces the size of a business’s payroll, decreasing payroll taxes in the process.

In terms of your employees, we’ve done some deep research about what they want and how well they’re prepared for retirement. Without going into too much detail, we saw that employees typically don’t have the savings they need for retirement, and that a retirement plan is one of the top two items on their benefits wish list. Fulfilling this need is a good way to build a stronger bond — and set yourself apart from the competition (because only half of small businesses offer a retirement plan).

{Question 6} @Zenefits: How important is it to start saving for #retirement early in your career? #Why401k @Guideline401k

@Guideline401k: #Saving early can make a big difference on your outlook. Check this out, @Zenefits!

The deeper dive:

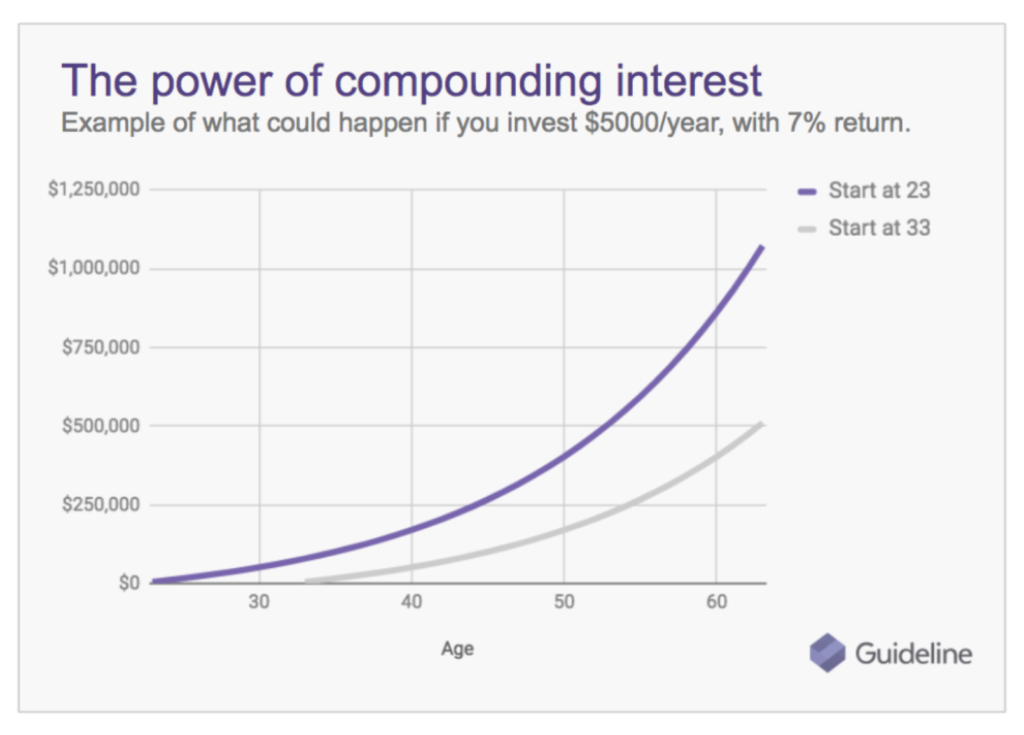

We mentioned earlier that saving $5000 a year to your 401(k) can lead to over $1 million in savings by the time you retire (assuming your investment grows at 7% a year, which is consistent with historical averages — disclaimer — nobody can predict future performance). Well, if you wait ten years to get in on the action, it could mean that you’ll save less than half as much by the time you retire:

The graph above is provided for informational purposes only. This projection is hypothetical in nature and intended to be illustrative. Accordingly, such information is not intended to constitute investment advice nor an assurance or guarantee of future performance. Past performance does not guarantee future results. Investing involves risk and investment may lose value. Investments are not FDIC insured.

Like we mentioned earlier, there are lots of reasons someone might not want to contribute to their 401(k), but finding a way to making 401(k) contributions part of your budget can make a big difference in your retirement outlook.

Guideline is a low-fee 401(k) provider that seamlessly integrates with Zenefits to offer full-service retirement plans which include compliance, fiduciary services, investment management, and more.

Interesting in learning how Zenefits works to integrate every aspect of your employee experience into one streamlined dashboard? Request a demo to learn more today.

Disclaimer: The information above is provided for educational purposes only and should not be construed as personal investment advice or a guarantee of performance. All investments involve risk and your investments could lose value. You are advised to consult a qualified financial adviser or tax professional before relying on the information provided herein.